An Ultra-HNIs financial legacy is a masterpiece

painting, with each stroke representing a different

aspect of wealth.

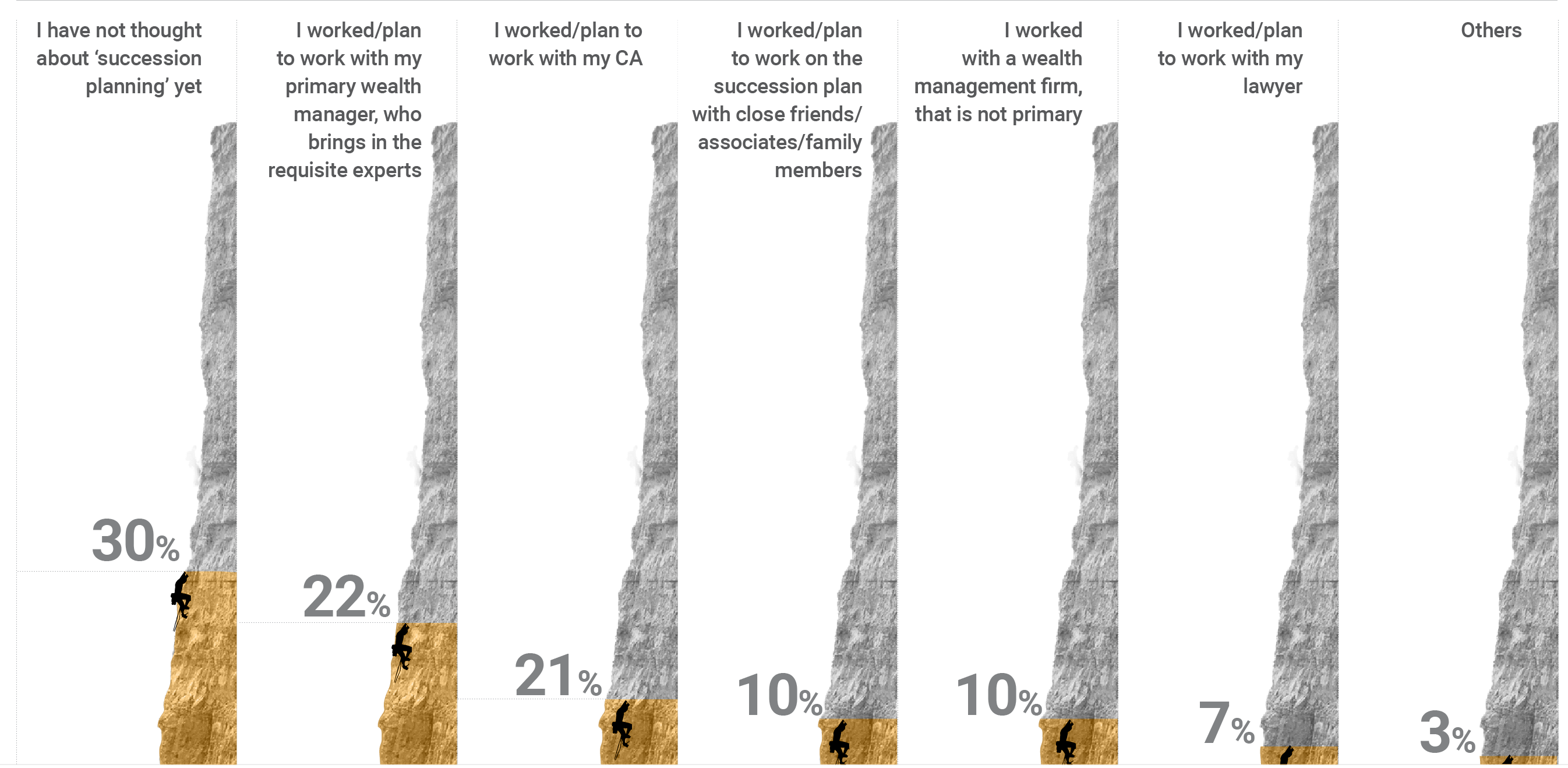

A comprehensive succession strategy cannot be

designed in silos. It requires seamless collaboration

between an Ultra-HNIs advisors – legal advisers,

chartered accountants, bankers and private bankers.

This approach ensures that every facet of wealth

transfer is meticulously planned, risks are minimised,

and benefits are maximised. This collaboration is not

only beneficial — it is essential.

The legal advisor adds the outlines, bringing in their

expertise in crafting wills and trusts, ensuring that

the succession plan complies with all regulatory

requirements and addresses potential legal

challenges. Their insight is crucial in safeguarding

assets from litigation and ensuring a smooth

transition.